Graphic provided by Help/Systems

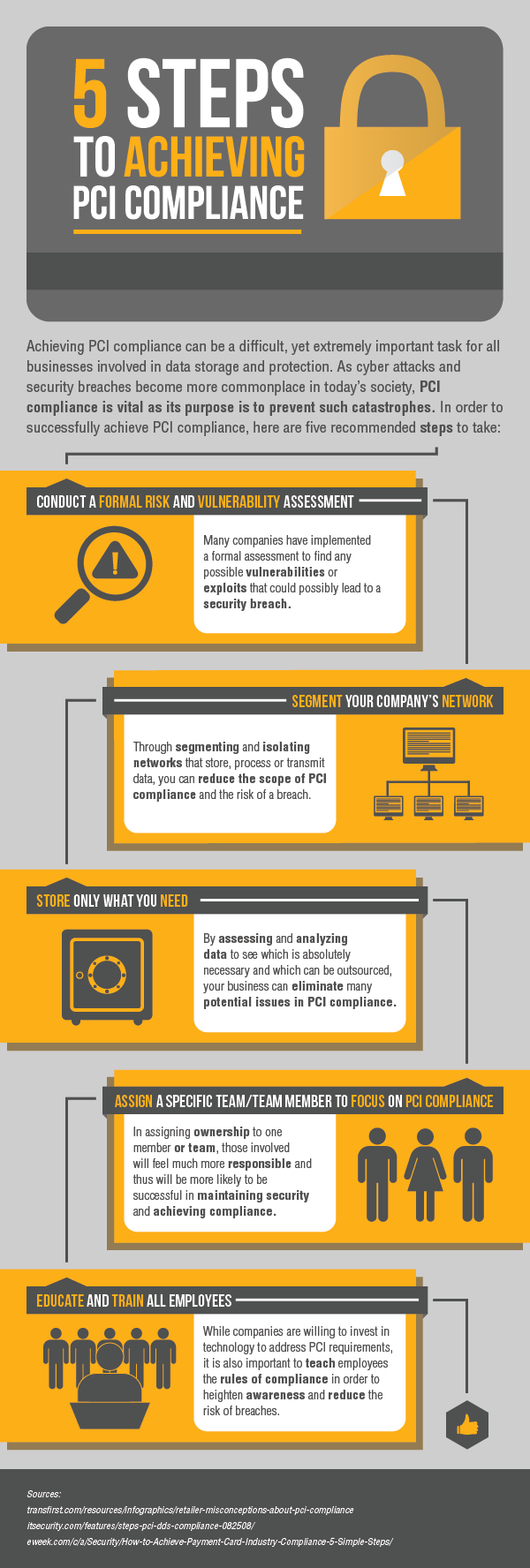

Achieving PCI compliance is essential for any business working with payment cards, regardless of their size. While it can be a difficult process, working toward this goal is vital for preventing any security-related catastrophes that could affect both customers and merchants.

To successfully achieve compliance, firms should conduct formal risk assessments to help expose any existing holes in their security that can be fixed before they become an actual problem. When doing so, business leaders should also consider segmenting their network and outsourcing any unnecessary storage to help minimize the scope of their strategy and greatly reduce the risk of breaches.

Lastly, it is important to focus on those within a business and how they may impact the path to achieving PCI compliance. Although educating and training all employees to help heighten awareness is essential, it is also important to assign just one team or team member to strictly focus on achieving compliance. This will help establish a sense of responsibility that will contribute to better-maintained security overall. For more information on how to achieve PCI compliance, check out the infographic below.